If you’re on the hunt for a credit card that balances rewards, flexibility, and credit-building opportunities, the Summit Credit Card might just be your perfect match. Whether you’re a student, a professional, or someone who loves to travel, this card offers a little something for everyone. Let’s dive into what makes it stand out and whether it’s worth adding to your wallet in 2025.

Why the Summit Credit Card Shines

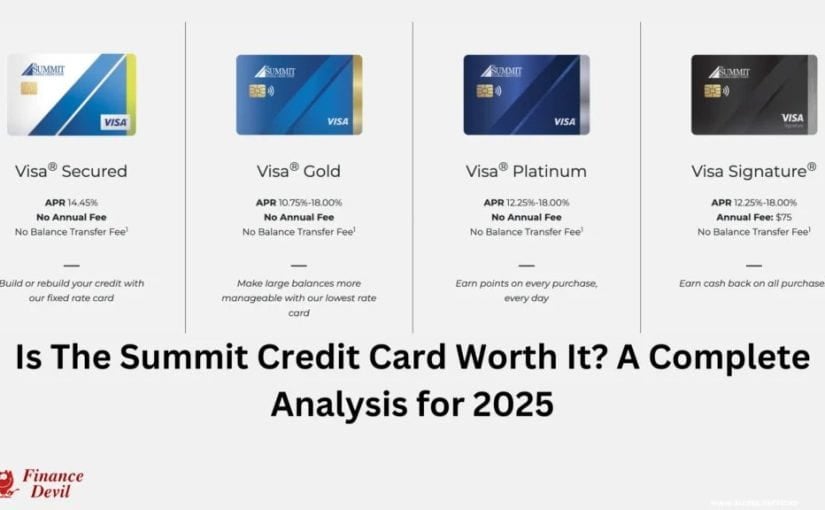

The Summit Credit Card isn’t just another piece of plastic—it’s a financial tool designed to adapt to your lifestyle. With rewards like 3% cash back on dining, 2% on groceries, and bonus points for travel, it’s hard to ignore its appeal. Plus, it comes with low or no annual fees, making it a budget-friendly option for those who want to maximize their spending power without breaking the bank.

For those looking to build or rebuild credit, the Summit Credit Card offers free credit monitoring and reports to major credit bureaus. And if you’re a frequent traveler, you’ll appreciate perks like no foreign transaction fees and travel insurance.

But Is It Right for You?

While the Summit Credit Card has a lot to offer, it’s not without its drawbacks. The high APR rates might be a turnoff for some, and niche options like the Summit Racing Equipment Credit Card are limited in scope. However, if you value rewards, low fees, and credit-building tools, this card is definitely worth considering.

Final Thoughts

The Summit Credit Card is a versatile option that caters to a wide range of financial needs. Whether you’re looking to earn rewards, build credit, or enjoy travel perks, it’s a strong contender for 2025. Take a closer look at its features and see if it aligns with your goals—it might just be the financial tool you’ve been searching for.